Introduction

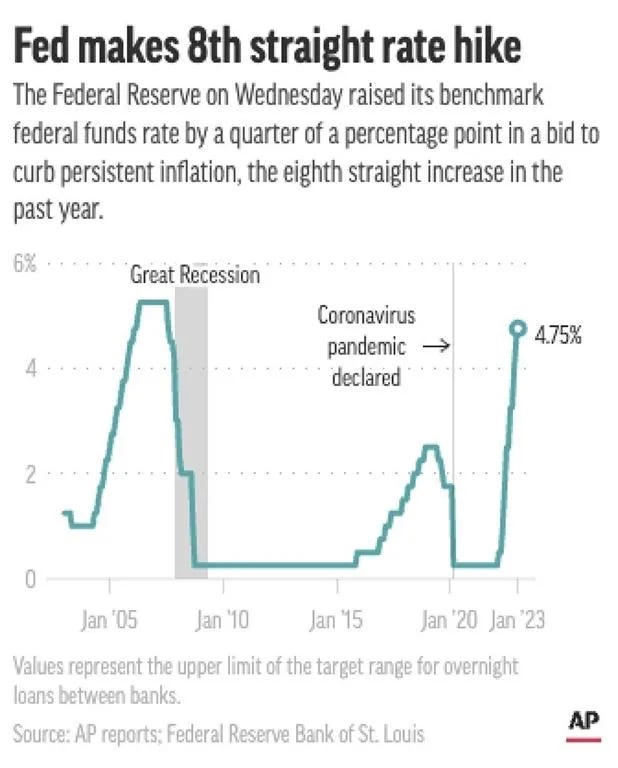

A few days ago (February 1st 2023), the Federal Reserve System (Fed) announced that its raising interest rates by 25 bps (0.25%).

What does it mean exactly?

If you're an investor (like me), it's important to somewhat understand what's happening on a macro-economic scale and what the Fed is doing.

This post is meant to provide some insights and understanding.

What is the Federal Reserve System (Fed)?

The Fed is the central bank of the United States.

It's a public institution that's responsible for monetary policies & manages the currency of a country.

Every country has such a central body (ECB in Europe, BoJ in Japan etc).

So what do they do?

Arguably, the most important thing is to promote maximum employment, stable prices, and moderate long term interest rates.

They have other tasks but we'll focus on just the core tasks in this post.

Jerome Powell is the chair (head of the Fed) and is instated by The President Of The United States.

How?

It all revolves around 'inflation'.

All countries have a currency which is used as a means of payment. USD in the USA, EUR in EU, JPY in Japan and so on.

But these supplies aren't fixed. Every day, new money is printed and brought into circulation.

It's inflated.

Can't we just keep a fixed amount of money in circulation?

We can but we won't.

Countries and economies compete with one another and in order to increase growth, money is needed.

Governments need tools to increase spendings. Sometimes far beyond what they're earning.

Inflation and deflation

The Fed have a 2% target inflation rate.

Too high inflation isn't good. People would lose trust in the currency and park their funds elsewhere.

Also, newly printed funds wouldn't find a buyer.

So what about the opposite, deflation?

Deflation isn't good either. People would hold on to their money and not spend it (after all - it gets more valuable over time).

As a result, prices of services & goods would go down and supply increases. It undercuts the production and leads to layoffs & unemployment.

Back to the Fed

The Fed can't make laws to regulate the economy but it can act indirectly, by changing the money supply.

It's important to understand that the Fed are like a master bank. They dictate how much money commercial banks need to have on hand etc.

Interest rates

When you take out a loan, you typically pay back the full amount and an extra percentage (the interest).

So when the Fed put low interest rates, it means that you can afford to borrow more money or more people can afford to borrow.

The money supply increases.

Obviously the reverse is true as well.

High interest rates decrease the money supply over time.

Key in this whole story is trust. Price stability, stable inflation (+/- 2%) and high employment provide a great foundation for steady growth.

Unfortunately it's not always easy to steer the ship in the right direction.

Wars, pandemics, global disasters and other events tend to push economies in the red.

Inflation thrives, sometimes together with high employment.

In short

The Fed has been hiking rates consistently.

It becomes more and more expensive to borrow money (Loans, Credit Card and more).

It also becomes more and more interesting to keep funds in the bank as they raise their interest rates accordingly. Do proper planning.

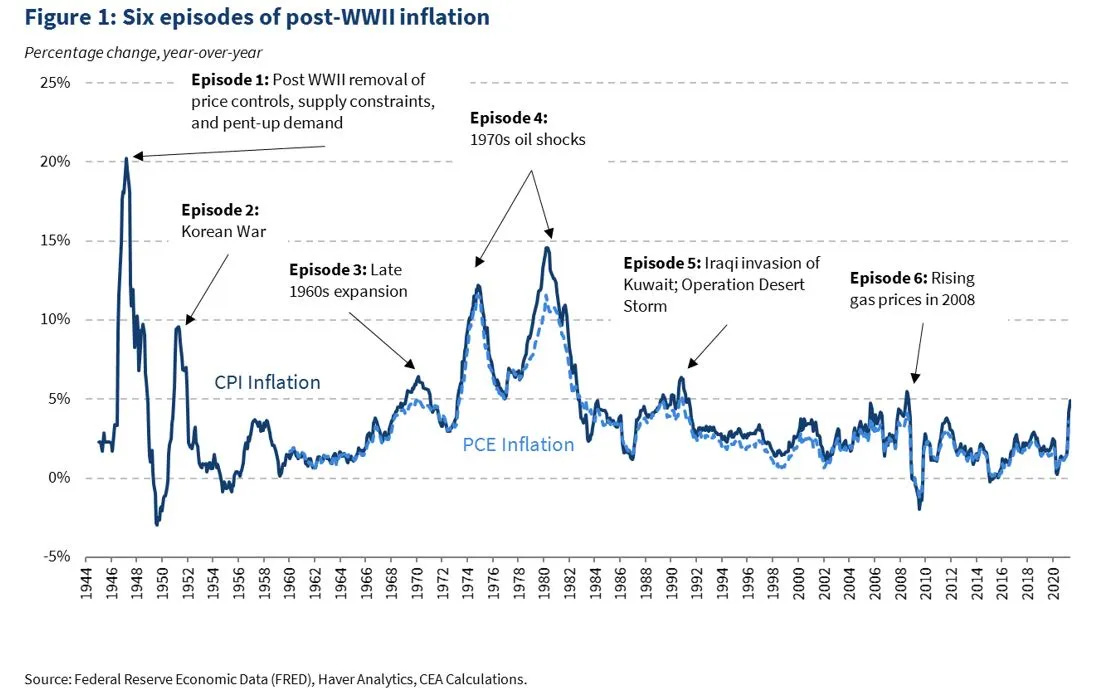

CPI & PCE

CPI (Consumer Price Index)

It measures the average change over time in prices for a basket of goods and services.

So basically, what are households purchasing and how did that change over time?

Currently sitting at +6.5% over the last 12 months (Dec '22 data).

PCE (Personal Consumption Expenditures)

The Fed looks at the PCE instead of the CPI to estimate the current inflation.

Whilst CPI tracks goods and services consumers buy directly, PCE also tracks items bought on behalf of consumers.

What have businesses sold to consumers?

An example

Healthcare costs

CPI would only track how much you'd pay, out-of-pocket, for the help you receive

PCE looks at a bigger picture. It measures healthcare services for consumers that are paid for by others, such as employers.

What's the difference CPI vs PCE?

As the graph below shows, PCE is usually a bit lower than CPI but the numbers tend to follow each other quite well.

The PCE is slightly more stable and less volatile than the CPI.

Also note the green 2% inflation target line.

DXY (US Dollar Index)

It's a measure of the value of USD relative to a basket of foreign currencies.

Thus the higher the DXY goes, the stronger USD is perceived (more people are willing to buy & hold it).

The DXY has been dropping since Nov 2022.

Recent unemployment numbers might impact this narrative in the coming weeks.

Conclusion

Markets are rallying whilst inflation hasn't been curbed just yet.

It's true that some of the events have already been priced in but I'm still a bit weary on these rallies.

Use this post as a guide and DYOR!

Nice work! Would be happy to exchange recommendations if you like :)