Introduction

The U.S. Bureau of Labor Statistics (BLS) announced on 03/02/2023 that:

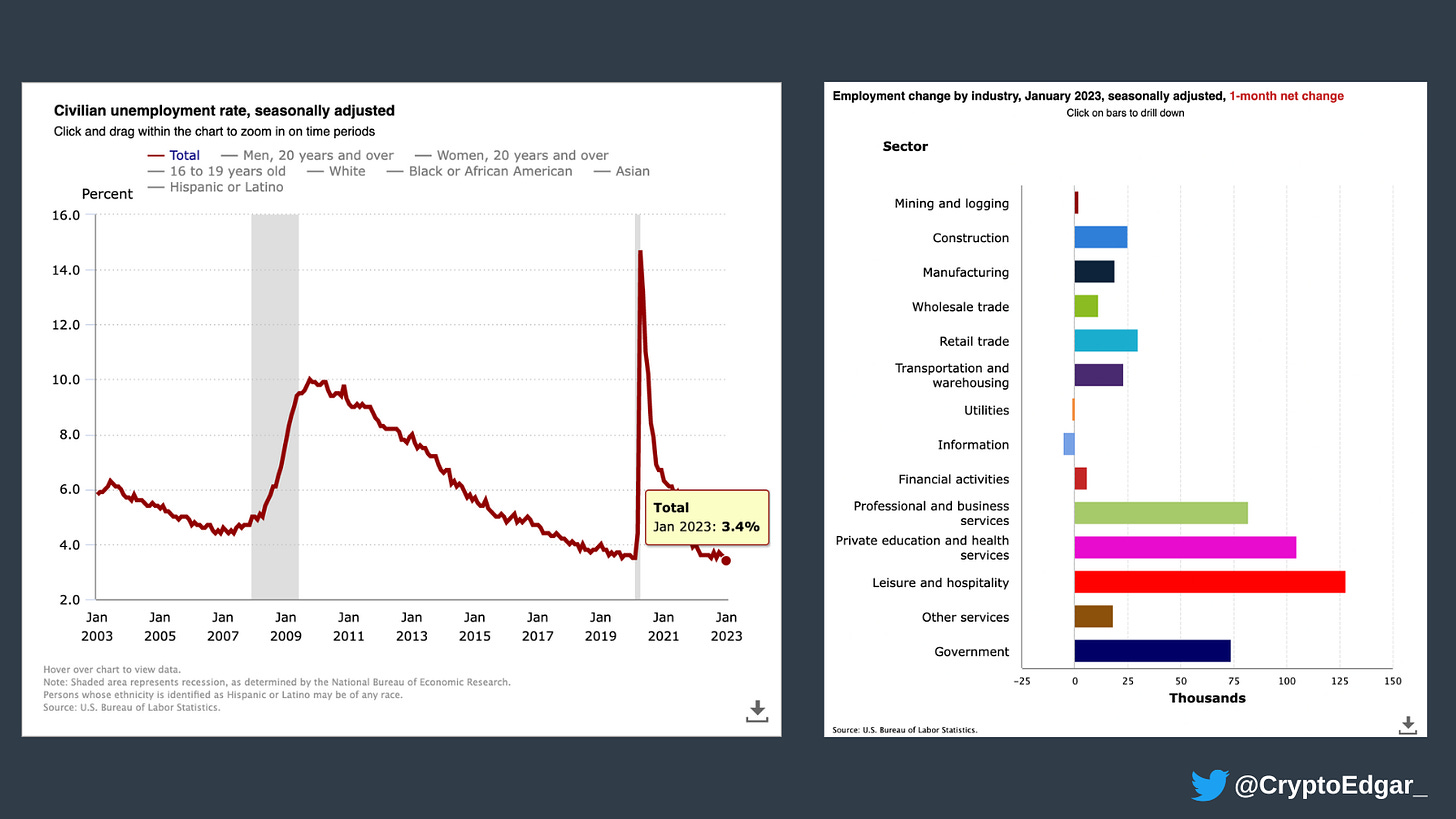

Unemployment Rate fell to 3.4%

517,000 jobs were added in January '23

Sounds like good news but in a way, it's not.

The Fed were aiming for an unemployment rate of at least 4%.

But why? How could this impact our long term investments?

Goals of the Fed

Remember that two important goals of the Fed are:

Promote maximum employment

Price stability (inflation of 2%)

The Fed are raising rates to make it more expensive for consumers to take on debt and reduce purchasing power.

Less purchases means more leftover supply - and eventually layoffs.

In addition people travel less, dine out less and so on.

The mission of the Fed was explained in the last newsletter:

Are these goals achieved?

The Fed’s reasoning is contrary to what’s being observed in Jan ‘23.

Unemployment went down

There could be several reasons for the drop in unemployment:

More people found jobs

Some unemployed people gave up searching for jobs

Why doesn't the Fed like less unemployment?

Short answer: Because it tightens the job market.

Unemployed people cut back on spending. They help to cool off the economy.

If less people seek a job, employers will need to offer a higher pay to attract employees (wage growth).

Source: https://www.bls.gov/charts/employment-situation/civilian-unemployment-rate.htm

Job growth sectors

The sectors where we’d we'd expect rate hikes to hit the hardest actually experienced the biggest growth.

Leisure and hospitality (128,000)

Private education and health services (105,000)

Professional and business services (82,000)

Source: https://www.bls.gov/charts/employment-situation/employment-by-industry-monthly-changes.htm

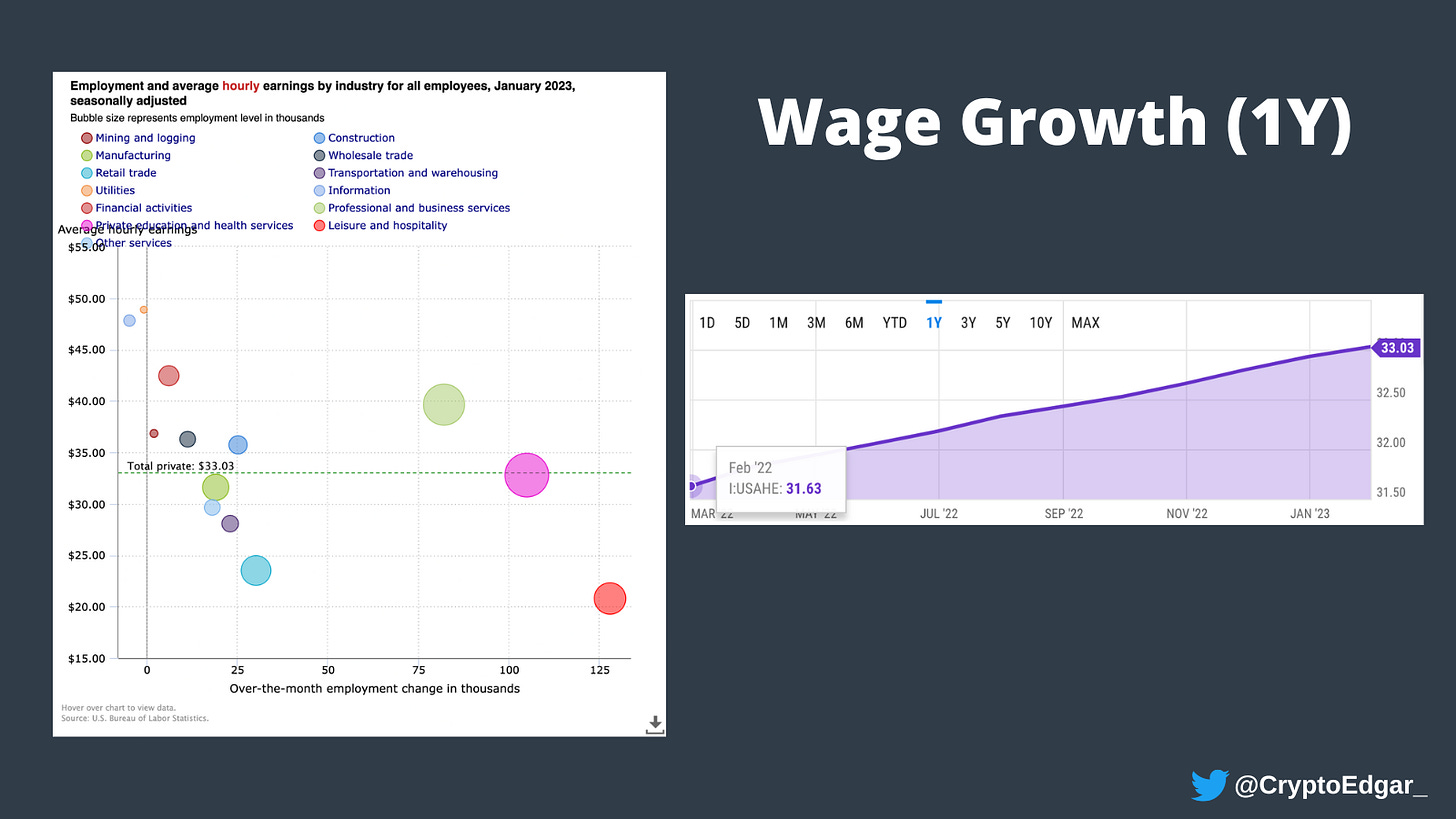

Wage Growth

The average employee now earns $33.03 hourly (up from $32.93 in Dec '22). This is a 0.3% rise.

Wages rose by 4.43% compared to one year ago.

Note the green dotted line in the chart on the left and the earnings of each respective industry.

Does the Fed think the current hikes are sufficient?

Not once did the Fed signal that rates would get cut this year. Add the (unexpected) unemployment data on top of this.

It's not entire clear what the Fed will do next. Powell mentioned that ongoing hikes will be appropriate.

Maybe we don't stop at 5.25%?

"The markets aren't buying what the Fed is peddling"

Is it all bad?

Well - No

The inflation is coming down. It's around 5% now (coming from 7% last summer) but still far above the aimed 2%.

Wage growth did come down slightly as well (compared to last month).

In some areas we seem to be going in the right direction.

The DXY

The dollar gained in strength vs a basket of other currencies as soon as the unemployment numbers hit the news.

For now it seems that the downtrend has been temporary halted. Recent CPI numbers might strengthen this current trend.

Investors could be a bit worried that the Fed might keep raising the interest for longer and higher until their goals are reached.

Conclusion

Fed Chair Powell spoke to David Rubenstein (interview below) and mentioned this:

Maximum employment means if you want a job, you can get one.

So right now the labor market is, at least, at maximum employment. Many would say that it’s out of balance. There’s even more demand than there is supply.

So what we’re trying to do is get inflation down. We’re not targeting, a different unemployment rate.

It’s clear that the inflation is sticky (yesterday’s CPI numbers somewhat confirm this). The fact that the theory of the Fed isn’t working in practise might be an indication that they need to raise rates even higher than what they were initially planning to.

The next FOMC meeting is planned for March 21-22 .

It’s my personal belief that we’re not out of the woods yet and might be looking at more pain before things start to turn around.