StepN GMT tokenomics explained

On March 9th, between 02:00 and 03:00 AM UTC, 60.25M GMT were unlocked and distributed. Is this sustainable & according to the plan?

Introduction

StepN launched its public beta in December 2021 after several months of development.

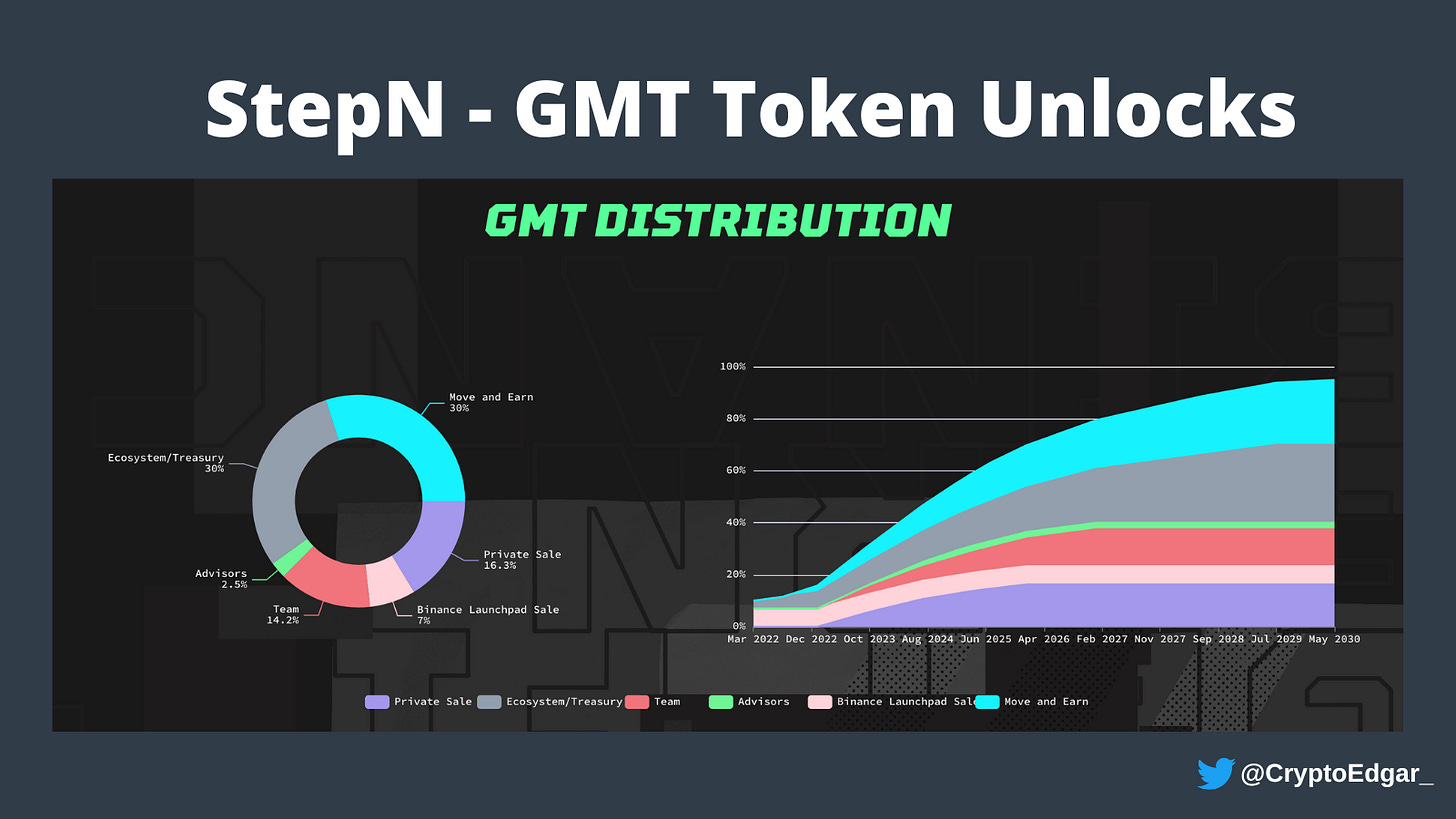

In order to fund their activities, they successfully raised $5,000,000 from private investors such as Sequoia Capital, Folius Ventures & Morningstar Ventures by selling 16.3% (978M) of their total GMT token supply (6B) during their private sale.

In the public sale (IEO), conducted on the Binance launchpad, another 7% (420M) of the total GMT supply was sold for a total of $4,200,000.

The GMT token unlocks that occurred on March 9th were a result of the contracts signed between StepN (seller) and their investors during the private sale.

This article will break down the full GMT tokenomics and dissect the flow of funds.

Token Lockup & Vesting

It’s a common practise to agree upon a certain ‘Lockup’ and ‘Vesting’ scheme to give the project some time to build without the immediate pressure of investors and the need to worry about the token price.

Lockup (Tokens are locked in a contract - they can’t circulate):

Binance Launchpad Sale: None, immediate release

Ecosystem/Treasury: 90% locked up (1.62B), 10% released immediately (180M)

Move and Earn: 5 months (until 08/2022)

Private Sale, Team and Advisor: 1 year (until 03/2023)

Vesting (Timely release of a certain percentage of the total supply. Starts AFTER lockup finished):

Ecosystem/Treasury: 0.3% (18M) monthly until 07/2029

Move and Earn: 0.42% (25.2M) monthly until 07/2025, less afterwards

Private Sale: 0.62% (37.2M) monthly until 01/2026

Team: 0.3% (18M) monthly until 01/2027

Advisor: 0.1% (6M) monthly until 01/2025

Adding up all the numbers brings us to a total of 1.74% (104.4M) GMT that will be released every month.

Note: The FED aims at a 2% inflation rate YEARLY to sustain the economy. It’s safe to say that the GMT inflation is extremely high.

Deep dive into the on chain data

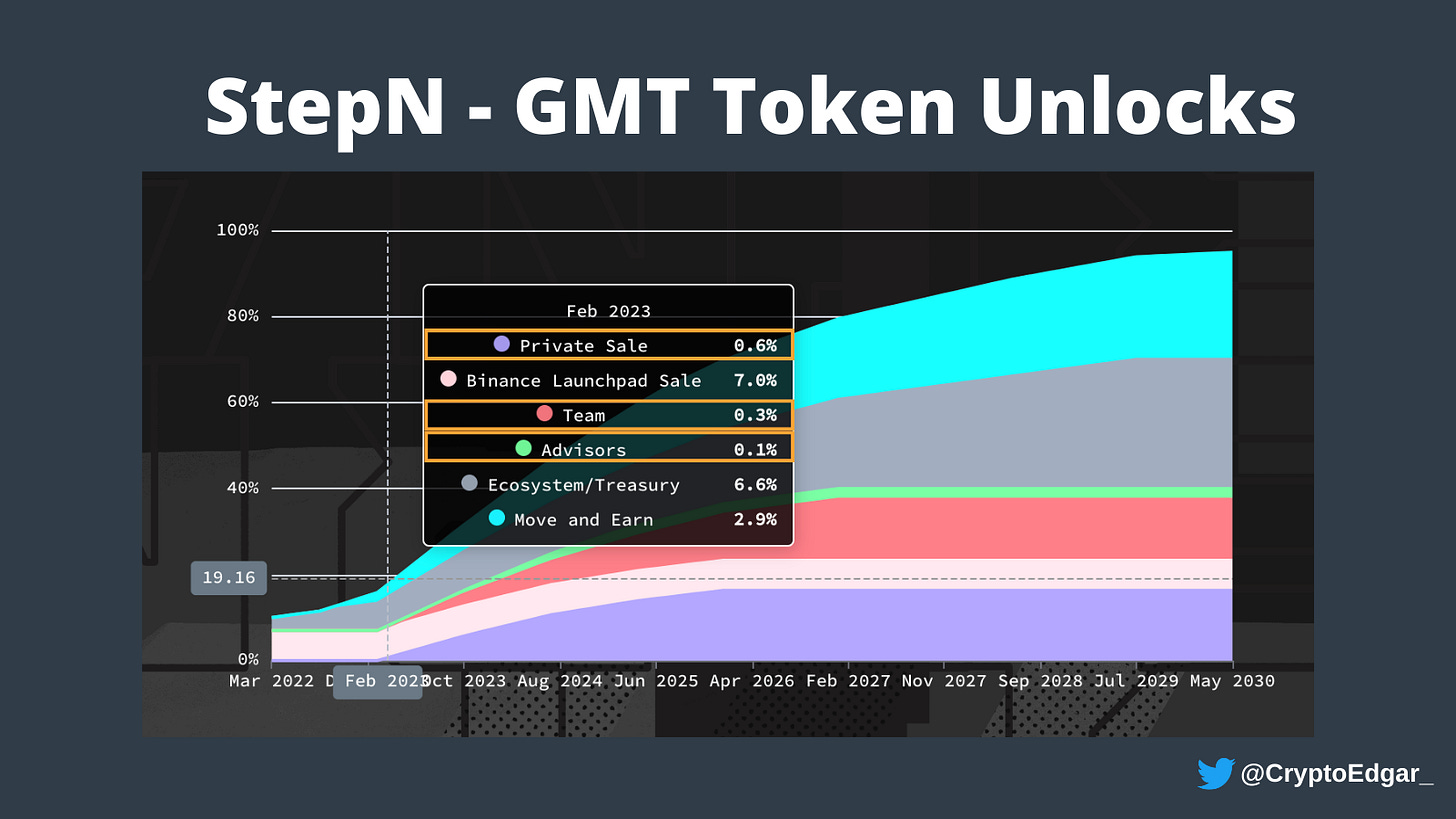

Thursday (March 9th) between 02:00 and 03:00 AM, a first batch of monthly vested tokens were released and sent to their recipients.

How much did actually go to each individual party?

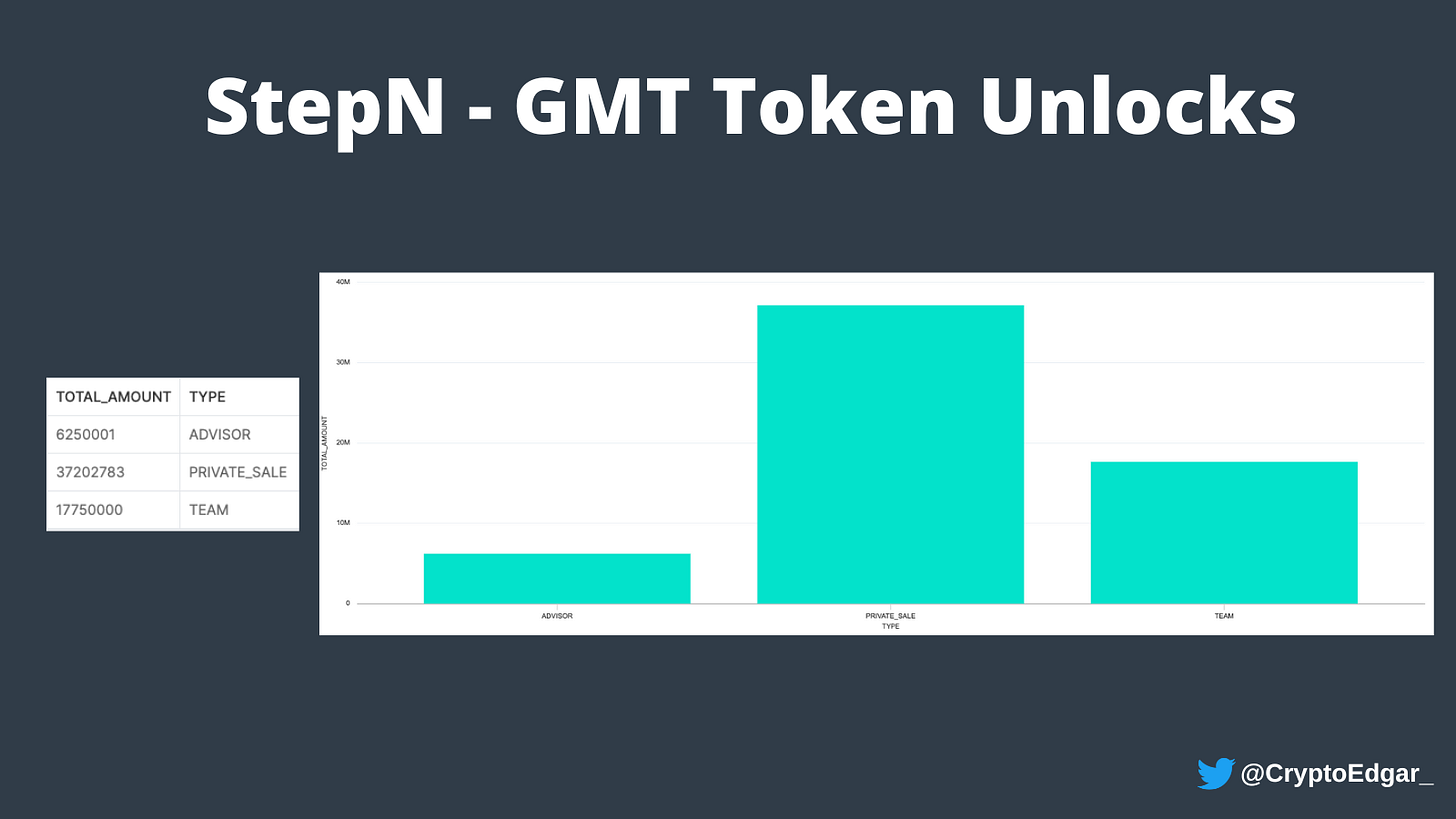

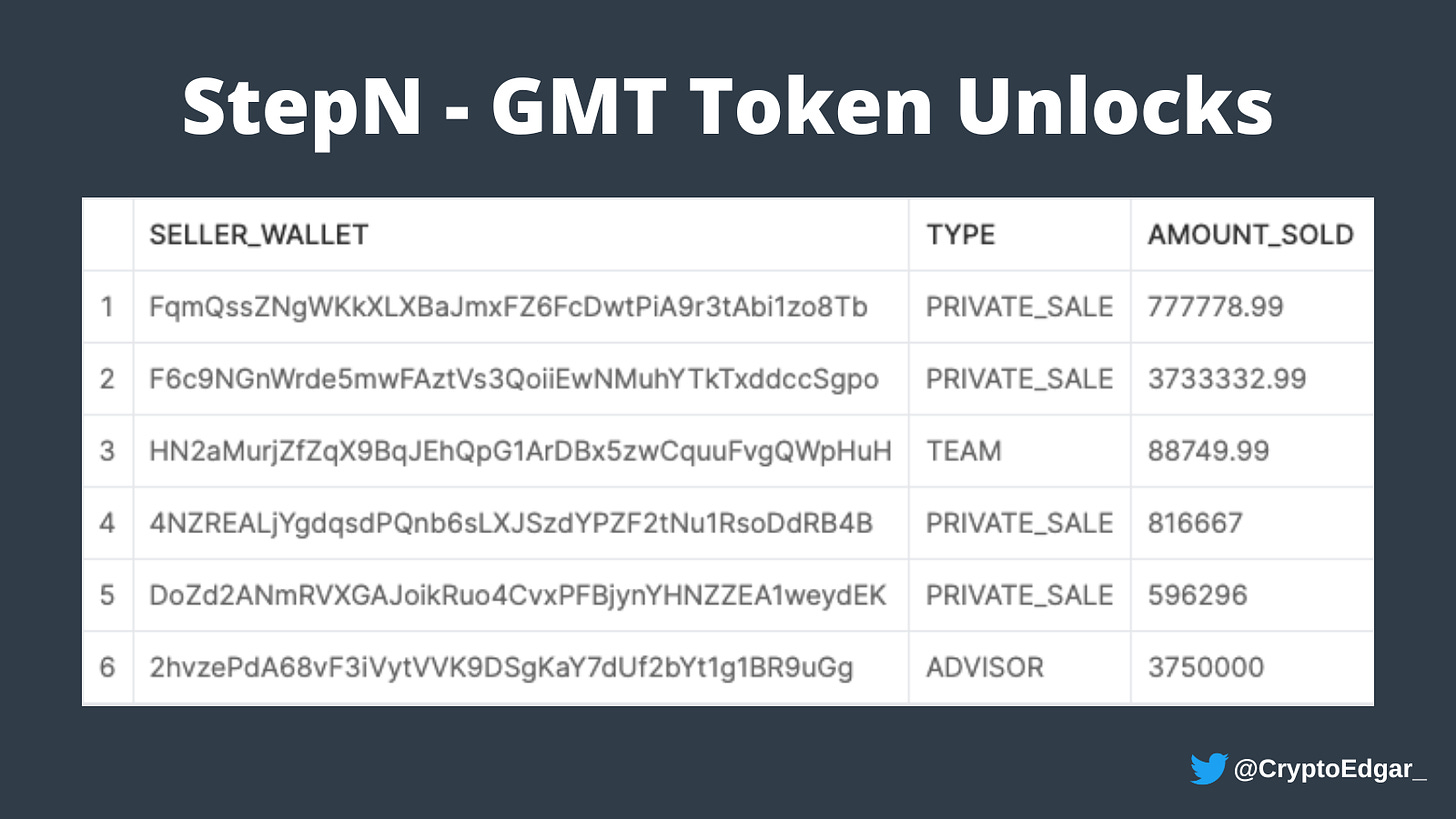

Private Sale: 37.2M GMT

Team: 17.75M GMT

Advisors: 6.25M GMT

It seems that 250,000 GMT, initially reserved for the team, went to an advisor wallet. It’s possible that a former team member stepped up as an advisor to the project.

Everything else was executed as planned.

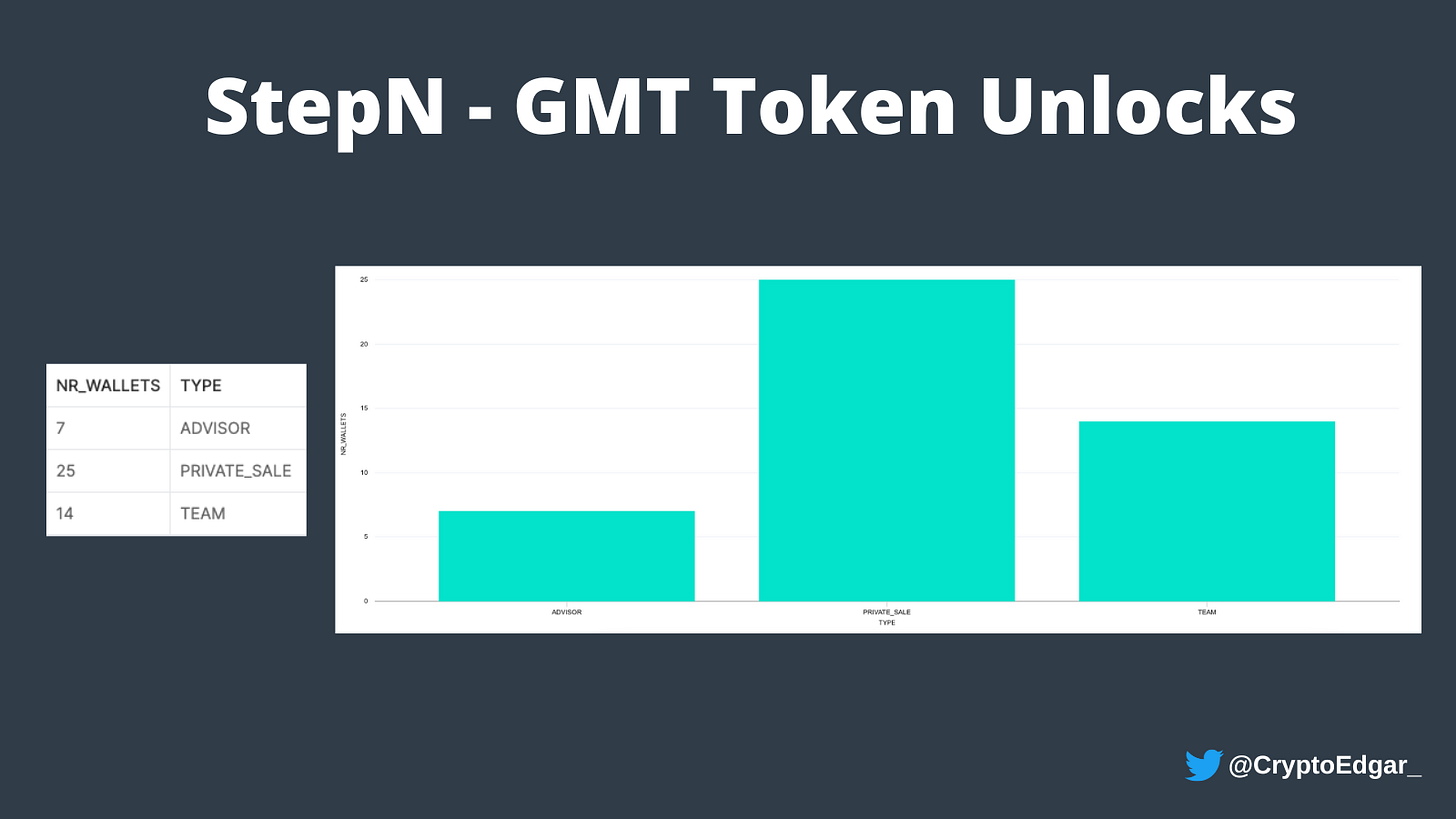

How many wallets are involved in each segment?

Private Sale: 25 unique wallets

Team: 14 unique wallets

Advisor: 7 unique wallets

Investors listed on Cryptorank are among the recipients of the private sale. Individuals such as ShardiB, PostyXBT, LadyofCrypto and others could be in this list as well.

They were all referenced in a former Twitter thread of mine.

Some of the advisors are mentioned on the StepN website.

William Robinson

Others

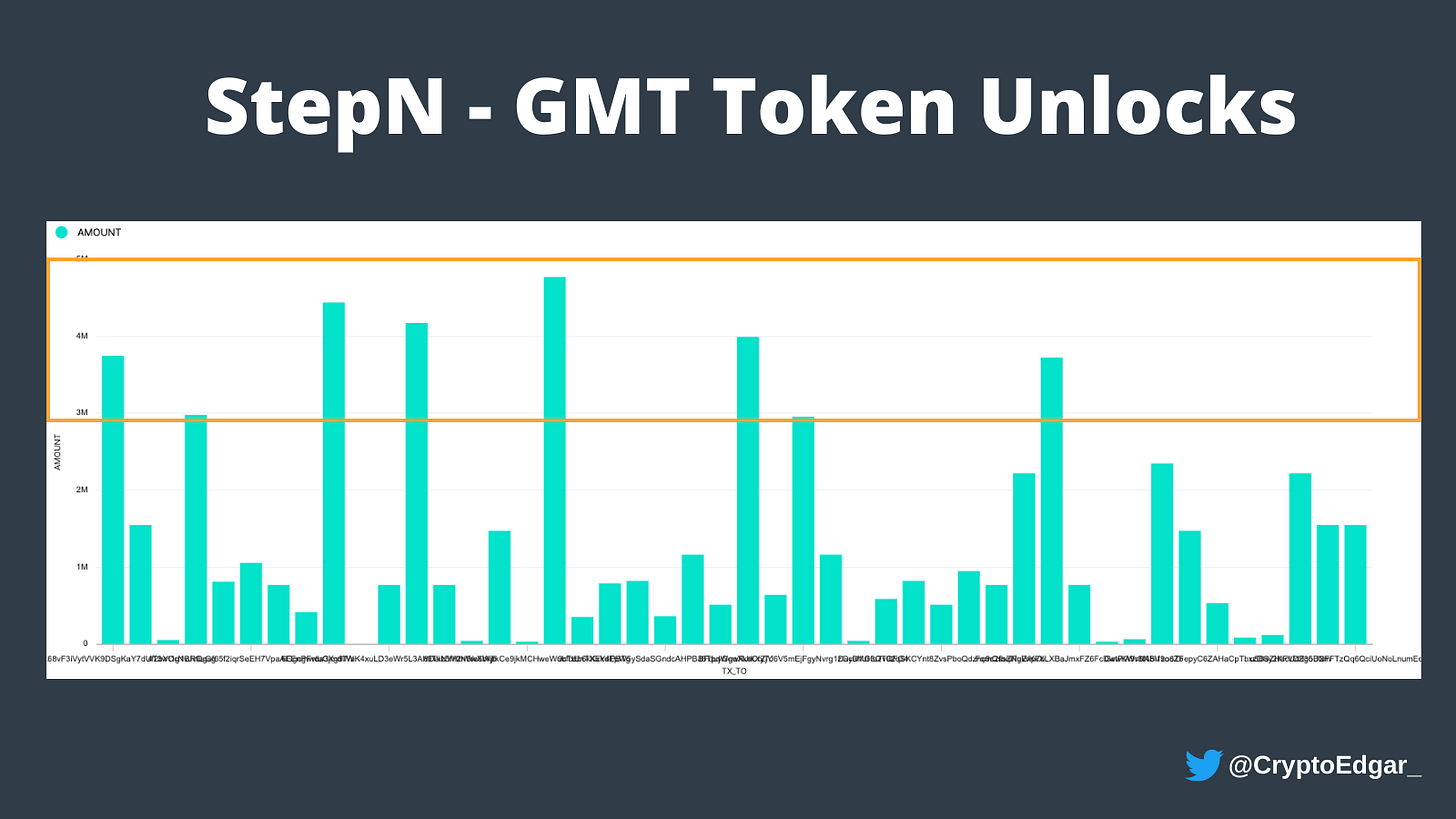

Are the tokens distributed evenly?

No

Private Sale: Those who invested more early on will receive a bigger piece of the pie

Team: The co-founders usually receive more than other project members

Advisors: The differences here are usually rather small

There are four ‘Private Sale’ wallets that have received over +/- 3M in tokens (4.44M, 3.99M, 3.74M and 2.96M respectively). The first two most likely belong to ‘Sequoia Capital’ and ‘Folio Ventures’ as they were the lead investors during the private sale.

Two ‘Team’ wallets received 4.77M and 4.17M respectively. They might belong to Yawn & Jerry.

One ‘Advisor’ received a total of 3.75M GMT whilst the next ones ‘only’ got 826K. This discrepancy is rather strange.

Note: It’s unclear what happened with the tokens that were initially reserved for ‘Alameda Research’. A cryptocurrency trading firm that filed for Chapter 11 bankruptcy after the fall of FTX.

What are the recipients doing with their tokens?

So far a total of 9.76M GMT was sent directly from the recipient wallets to Binance (and probably sold).

A big private sale investor and the biggest advisor were among the sellers.

This isn’t great news. Big wallet holders selling on a monthly basis could create strong downwards pressure on the GMT token price.

Conclusion

Positives:

The amount of unlocked GMT tokens is according to the plan

Only 20% of tokens were sent straight from the wallet to Binance in the first 24h

Negatives:

The unlock timing is a bit unfortunate. Coincides with major macro economic turmoil

The monthly inflation rate of 1.74% is extremely high (until 2025)

Currently 19.3% of the full supply is unlocked. There's 80.7% still to come

Too few GMT burn and lockup mechanics to sustain the heavy inflation

None of the above should be taken as financial advice and is meant as an aid to help and increase your understanding of tokenomics and the GMT token in particular.